We have so much data and so much computing power. He talked about how quantitative investing and AI opportunities. They have recently cut the expense ratios on their core asset class ETFs to the lowest in the industry, said Fink.

Fink said they are spending large amounts on technology, including artificial intelligence (AI). At the same time, the investments under management have grown considerably.

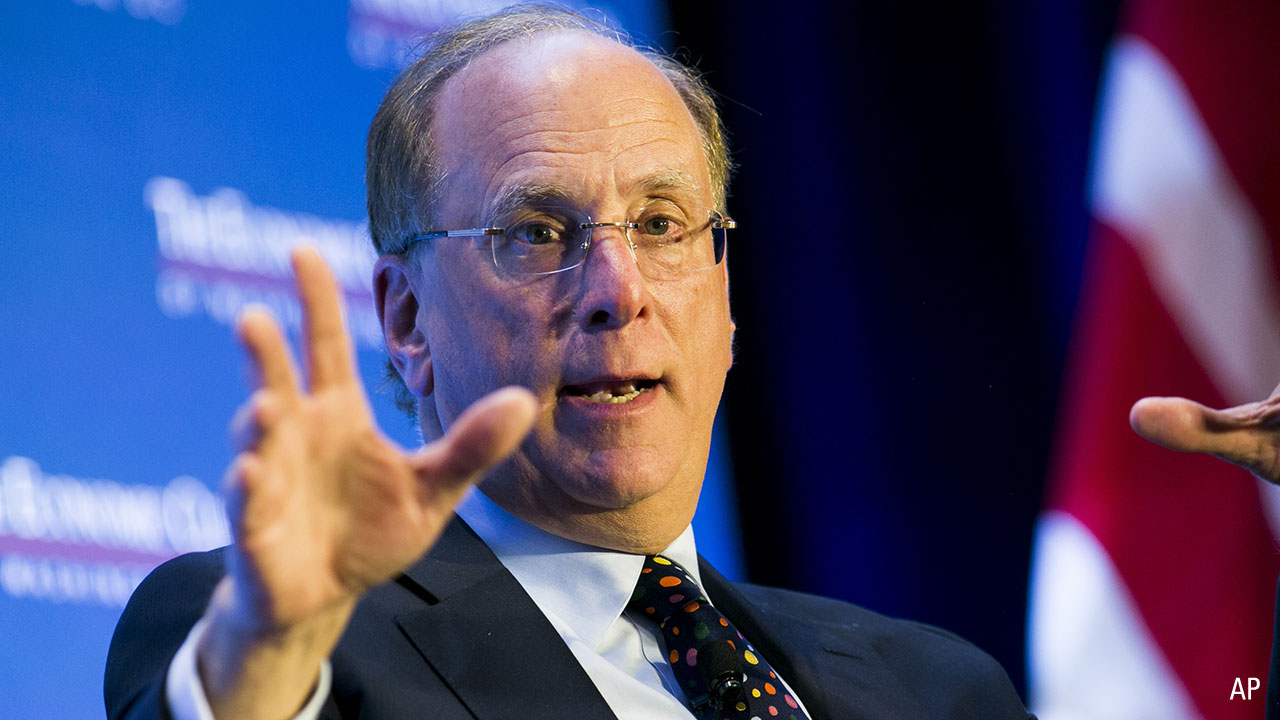

He noted that Blackrock has 13,000 employees and that number has been roughly flat for three years. He said that advisors should consider how they will interact with millennials and how they may need tools to meet the needs of this group. They would rather use electronic devices and educate themselves. He said they do not want to talk with people or take investment advice. He commented specifically on millennials. As a result, he said he felt that the need for good financial advice was as important as ever. As a result, he feels that the defined contribution plans (IRA, 401k) have been a ‘disaster’ for the US. Investors in the US have poor financial literacy. Defined benefit plans have continued to disappear. He notes interesting macro trends as a context. How the Wealth Advisor Business is Changing He said he felt that new factors will continue to emerge and he thought that their ETFs would be useful for this. Instead, they look to participate in major themes by targeting specific industries. In this type of active management, fund managers are not looking for alpha on a company by company basis. He sees ETFs based on sectors being used to implement macro based active management. He talked about a shift in how managers are employing active management. He specifically noted that he wants to get an integrated view of investment strategy and more closely align the stock pickers who focus on fundamentals in synch with the quant / factor based research teams. In fact, he said he thought the outlook for active investing is improving. He is not giving up on active investing and sees a roll for active fund managers going forward. He indicated that the factor and quant fund managers had been doing quite well with consistent returns. In Q1, they recognized their business and increased focus on bringing the quantitative portfolio managers together with the pure active fund managers. Blackrock also has a wide range of Smart Beta (factor based investment strategies) and active management funds. Passive index funds have seen large inflows in recent years. Passive Investingīlackrock is one of the largest providers of passive index funds. He did say he would like to see the government earmark the taxes from the repatriation specifically for infrastructure spending. Companies have had ample access to debt financing at low interest rates so he doesn’t think the repatriation will go into investment. On a more detailed note, he commented that a tax holiday on repatriation of foreign cash would likely get used for stock repurchases and possibly M&A. He said that debt and the deficit are not playing a central role in the tax reform debate. He commented that we have the highest debt to GDP of the G7 and 35% of this is ‘financed by the rest of the world’. He did sound a note of caution regarding US deficits. Regarding the new administration’s policies, he said that they are largely in line with ‘the bucket list’ of items Blackrock would like to see. “It is improbable given the US demographics”, said Fink. He doesn’t see the US hitting the 3% real GDP growth being targeted by the administration. He commented that consumer sentiment is strong, but this is not transferring to the c-suite (corporate suite / CEO level). He noted that outside countries seem to view the US as a ‘less welcoming’ place and cited weakness in hotel stays and foreign student enrollment in US colleges. His personal view is that US is taking a pause to ‘wait and see’ how the new administration’s policies unfold. Larry commented that this is the slowest of all of the top seven developed countries (known as the ‘G7’). Larry commented on the latest GDP figures from Q1. I thought a recap of his comments would be of interest. He spoke late last month at Morningstar’s Investment Conference and discussed a wide range of issues including the state of the US economy, the state of active and passive investing, and how the industry is evolving in light of rapid technology change. Larry Fink is Chairman and CEO of Blackrock, the world’s largest investment management company with over $5.4 trillion in assets including iShares ETF products. (Photo: Financial Times, Daphne Borowski, cc2.0)

0 kommentar(er)

0 kommentar(er)